What is a Private Equity Portfolio Strategy?

A private equity portfolio strategy is a comprehensive plan that outlines the objectives, risk management approaches, and value creation plans for a private equity firm's portfolio. It is designed to help firms and investors maximize their return on investment and ensure that their investments are managed efficiently. The strategy should be tailored to the individual firm's goals and objectives, taking into account the current market conditions and the firm's current and future investments.

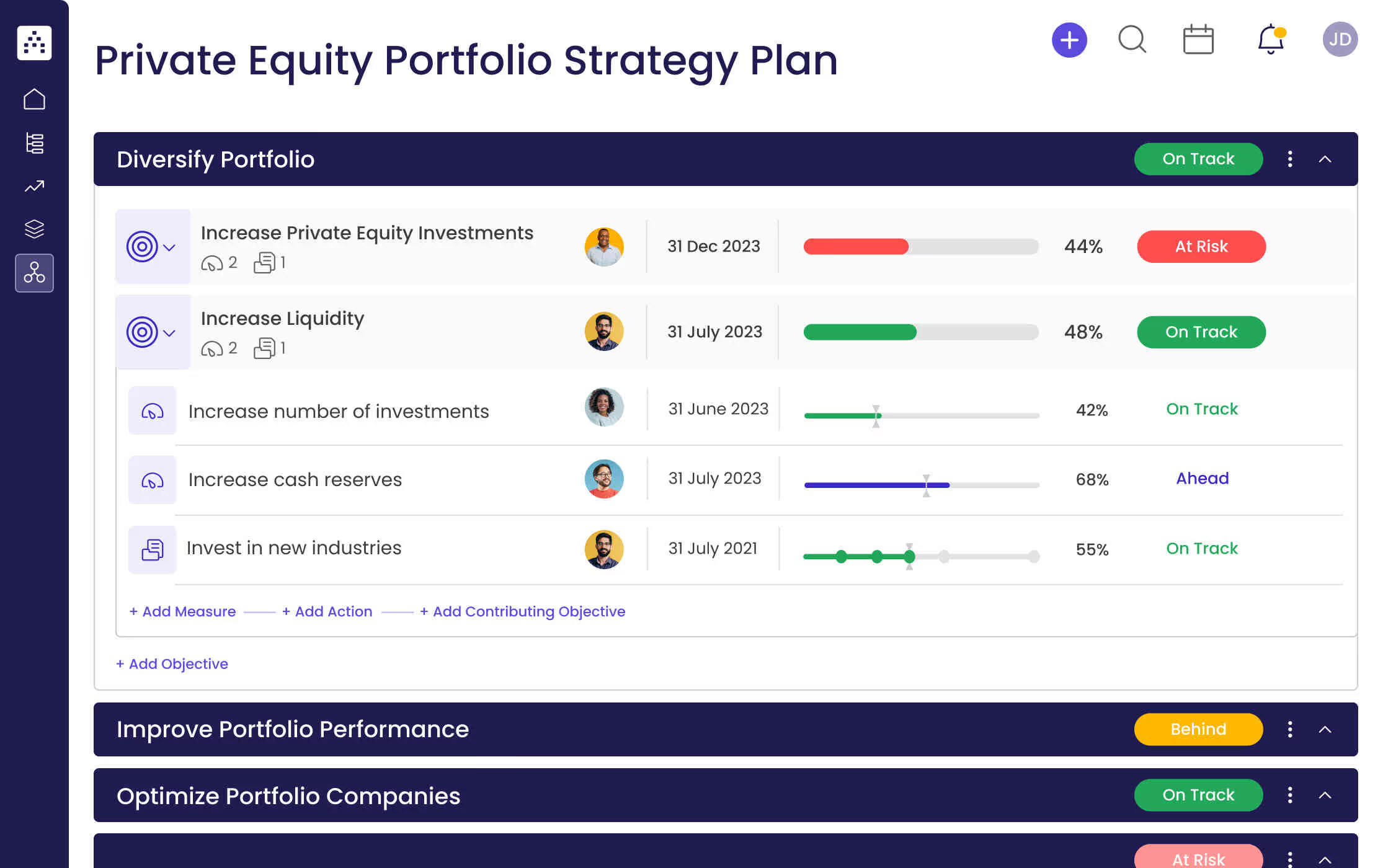

What's included in this Private Equity Portfolio Strategy template?

- 3 focus areas

- 6 objectives

- 6 projects

- 6 KPIs

Each focus area has its own objectives, projects, and KPIs to ensure that the strategy is comprehensive and effective.

Who is the Private Equity Portfolio Strategy template for?

The Private Equity Portfolio Strategy template is designed to help private equity firms and investors develop their portfolio strategies. It provides a structured framework that outlines the steps needed to create an effective strategy, such as defining focus areas, setting objectives, implementing projects, and measuring progress. The template can be used to create a comprehensive strategy that can be used to guide decision-making and ensure that investments are managed effectively.

1. Define clear examples of your focus areas

A focus area is the overall goal or direction that you want your portfolio to go. Examples of focus areas include diversifying your portfolio, improving portfolio performance, or optimizing portfolio companies. These are the overarching goals that you want your strategy to help you achieve.

2. Think about the objectives that could fall under that focus area

Objectives are the specific goals that you want to achieve within each focus area. For example, under the focus area of diversifying your portfolio, your objective could be to increase private equity investments. Under the focus area of improving portfolio performance, your objective could be to increase return on investment.

3. Set measurable targets (KPIs) to tackle the objective

Key performance indicators (KPIs) are the measurable targets that you set to measure and track progress towards your objectives. For example, under the objective of increasing private equity investments, you could set a target of increasing the number of investments by 10. This allows you to track your progress and ensure that you are on track to achieve your objectives.

4. Implement related projects to achieve the KPIs

Projects (actions) are the steps that you will take to achieve your objectives. For example, to increase the number of investments, you could implement the project of investing in new industries. This project should be tailored to the specific focus area and objective that you are trying to achieve.

5. Utilize Cascade Strategy Execution Platform to see faster results from your strategy

Cascade Strategy Execution Platform helps private equity firms and investors manage their portfolios. The platform provides tools that streamline the strategy development process, such as monitoring capabilities, data tracking, alignment features and project management. By using the platform, you can develop and implement your strategy quickly and effectively.