Foot Locker has remained the leader in the athletic footwear and athleisure apparel industry for more than 40 years and operates under its own name as well as other subsidiaries such as Lady Foot Locker, Runners Point, and Sidestep. The company has made a name for itself in North America, Europe, and New Zealand and even plans to break into the Asian footwear market soon.

Here are some recent stats from FY2020 that illustrate the company's dominant position in the athleisure and activewear industry:

- Generated $7.5 billion in sales, with retail shoe stores alone generating 5.4 billion

- Posted a profit of more than $2 billion

- Share Price of 57.3 USD in June 2020

- Has 3000 athletic retail stores globally with around 2000 in the U.S

- Operates in 28 countries

- Workforce of 51,000+ including full-time and part-time employees

Inspiring and empowering youth, Foot Locker continues to fuel the passion for self-expression.

But how did the retailing giant get to where it is today? Let’s delve deep to find out…

Exploring Foot Locker’s Roots

Foot Locker's story starts almost 150 years ago in a small shop in New York City. No one at the time could have predicted that this would be the start of an incredible journey that would see a small retail chain become a global leader in athletic footwear. But before Foot Locker got to where it is today, it went through several twists and turns. Here is the story of that incredible journey:

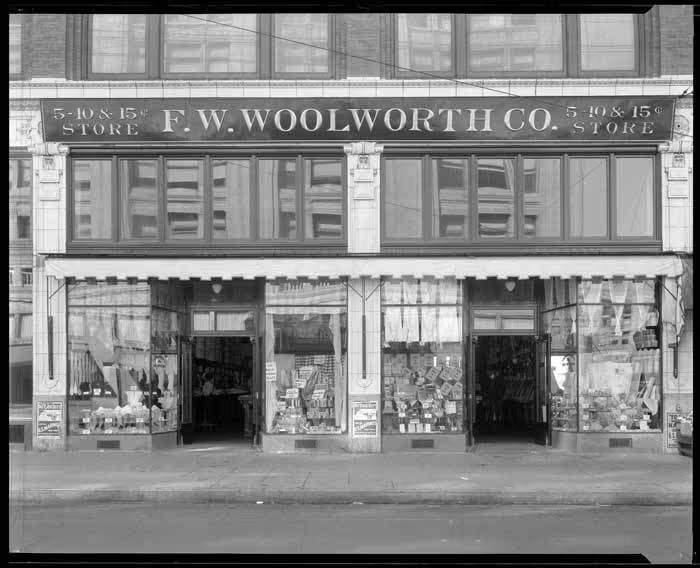

The Birth of A Retail Giant

In 1878, Frank Winfield Woolworth was a regular salesman in a small wholesale store. The business was going through some tough times as profits were low, and there was unsold inventory piling up. To turn things around, the shop decided to hold a 5-cent sale to sell off all that inventory lying around. The sale was a remarkable success, and it planted the idea of a ‘5-cent store’ in Woolworth’s mind.

The following year, Woolworth decided to start his own venture, the 'Great 5¢ Store’ in Utica, New York. At first, the store was a success, as the concept of a store that sold everything under the 5 cent line was a bit of a rarity. However, the store's location was less than ideal, and sales soon plummeted to the point that Woolworth was forced to halt operations.

However, Woolworth did not give up on his dreams and opened another store in a better location in Pennsylvania based on the same concept as the original store. This time his efforts paid off, and the store attracted many customers. One reason for this change of fortune was that Woolworth strategically diversified to include products in the 10 cents range and the original 5 cent products. By increasing the price limit, he provided his clients with a whole new range of items.

And so, the Woolworth retail chain was born. By the 1880s, there were several stores in New York and Pennsylvania. Woolworth and his business partners, including family members, ran these new stores.

Woolworth used another critical strategy to ensure that his stores would do well. He would hire managers to oversee his stores and give them an incentive to work harder by promising them a share of the store's profits. This wasn’t very common back then and his foresight of giving managers a piece of the pie would encourage them to drive the business forward.

Woolworth also paid close attention to the customers. In those days, patrons were not allowed to window-shop, but Woolworth encouraged people to come into the stores even if they just wanted to look around. His stores welcomed people regardless of socioeconomic background, and hence, not only attracted a range of prospects but also built a loyal customer base over time. This strategy worked so well that by 1889 Woolworth had opened his first store in Canada.

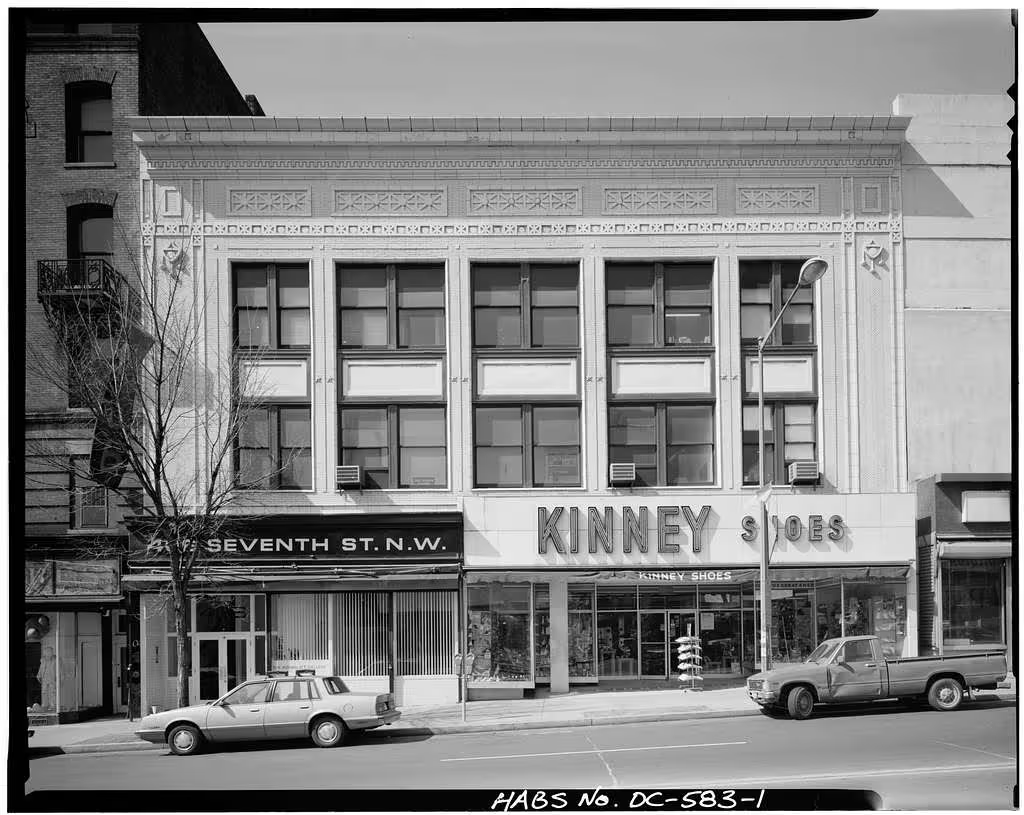

The Origins of Kinney Shoes

When Woolworth was launching his first Canadian store, a man named George Kinney had started running a small shoe store that sold affordable footwear to people who could not afford to pay much money. Little did Kinney know that his humble footwear chain would one day be acquired by a retail giant who would propel Kinney shoes on the international stage.

To ensure that his business would remain profitable, Kinney developed a simple formula for success. His target customer was lower-class shoppers, and to make sure that his shoes could retail at $1, he decided to purchase the goods in bulk to keep prices down.

Kinney would personally visit factories to inspect the goods and buy them, cutting out all middlemen who would eat into his earnings. This method proved so effective that Kinney was soon able to open up other branches of his growing footwear retail chain.

To ensure that productivity remained high in all his stores, Kinney would enter into partnerships with his managers and give them a share of the profit. Notice the similarities with Woolworth. Both companies employed the same strategy to motivate employees to work harder.

By 1916, Kinney Shoes had established more than 56 stores across the United States and was the go-to shoe store for most low-income to middle-income families. By the early 1920s, they had set up their factories to manufacture their own shoes. By purchasing their shoes wholesale, Kinney's could maintain its affordable prices even when other stores were increasing the price of their products.

Woolworth, too, was steadily expanding, and by the turn of the 20th century, the company had managed to make $5 million sales from their 59 stores across the U.S and Canada. The chain would open branches in England, Germany, and Cuba, racking up $303 million in sales. With the introduction of imported goods from various European countries, Woolworth offered its customers an array of new products. Visitors flocked to the store to get their hands on the imported merchandise sold at Woolworth's trademark 10 cents price point.

Key Takeaway 1: Slow And Steady Wins The Race

The rise of Woolworth was far from smooth, but that never deterred Frank Woolworth. He knew he had hit upon an innovative store concept, and he was willing to put in the hard work to experiment until his store finally took off. He also broke off from the traditional way of treating customers, created a welcoming environment for all, and shared profits with the store managers. All of this paid off as his customer base continued to expand each year.

Kinney, on the other hand, saw an opportunity to cater to the needs of people who needed affordable shoes. He pounced on the chance and began offering exactly what people needed: shoes at cost-effective prices. From buying goods in wholesale to giving employees a stake in the business, he leverages various strategies to scale up.

When Woolworth Met Kinney

While Woolworth saw tremendous growth in the first half of the 20th century, things took a turn for the worse as WWII decimated economies across mainland Europe. To complicate matters, most of Woolworth's male employees enlisted with the armed forces, which meant the company had to deal with labor shortages and supply-side issues due to war-time rationing. Furthermore, people saved up their income instead of spending it on non-essential goods and services. According to Lizbeth Cohen’s book - A Consumer’s Republic: The Politics of Mass Consumption in Postwar America - people in the U.S were saving 21 percent of their income compared to just 3 percent in the 1920s. This meant there was less demand for shoes at a time when the company was already struggling.

WWII Setback

After the dust settled on the war, the most pressing problem was highlighted: the way the management ran the company. After the war, the economic situation had improved considerably, and people could afford to pay more for goods and services. Many war veterans had returned so that consumer demand for goods was higher than ever before. The U.S economy was doing so well that consumption rose dramatically after the war. People were buying homes and purchasing all kinds of appliances, but unfortunately, Woolworth did not keep up with changing times, resulting in massive losses for the corporation.

The main problem holding Woolworth's back was the management's cautious business style. While that had worked in their favor during the war, it hurt them following WWII. Woolworth stubbornly stuck to its guns and kept selling low-priced goods, but the post-war boom had increased the spending power of consumers, and they began to leave Woolworth to shop at more well-heeled establishments.

Consequently, earnings hit an all-time low of $29.8 million. As 1953 rolled in, the management began to realize that they would have to get rid of their overly cautious business strategy and come up with a more ambitious one. At that time, the company president was James T. Leftwich. He embarked on an aggressive modernization drive to upgrade existing stores and open new branches overseas in Puerto Rico and Mexico City.

In the following years, Robert Kirkwood took over, and he instituted several vital changes to eliminate the company's main stumbling blocks. He raised the ten-cent price limit to include higher-quality products such as textiles. He also spent considerable sums on advertising the retail chain aggressively and opened up new Woolworth's stores in the new malls springing up across the United States in the 1960s.

Another important strategy to minimize operational losses was providing job training and increasing employee benefits. The result was that sales people were incentivized to work harder instead of looking for better opportunities elsewhere.

Retail Giant Meets Footwear Chain

During the first half of the 1960s, Woolworth faced stiff competition from Kresge, who launched the first Kmart store to fit the new retail mall culture better. As a response, Woolworth opened the first Woolco; a modern department store spread over 100,000 sq ft. The store sold a wide range of goods and services, from clothing and cosmetics to kitchen appliances. It was the equivalent of a modern-day Walmart. The company was also on the lookout to acquire small businesses to sell their products in the newly established Woolco stores.

In 1965, they finally struck gold and acquired a family shoe chain for 39 million dollars. It was the G.R. Kinney Corporation which was the very same Kinney’s shoe store that George Kinney started way back in the 1880s. The chain had come a long way from its humble beginnings and now had 500+ stores in the country.

Although Woolworth had transitioned from a five and ten-cent store, it still sold an affordable range of goods. At the new Woolco, it needed an affordable footwear section, and it found the perfect solution in Kinney Shoes. The shoe company had already established itself as the largest family footwear retailer in the country, with multiple branches not just in the city but also along highways and in the suburbs. Kinney shoes were practically a household name. Hence, by acquiring the chain, Woolworth had practically made sure that families would flock to their Woolco stores to shop at their go-to footwear brand.

Key Takeaway 2: Time and Tide wait for none

To run a successful retail chain, companies need to have a forward-looking approach to keep up with changing economies and consumer preferences. Woolworth learned this lesson the hard way when it stuck to its traditional ten-cent products when consumers were eager to spend their war-time savings on goods and services. However, Woolworth eventually changed its strategy and modernized its stores. It also eliminated the 10 cent price limit and introduced more profitable goods such as clothes and cosmetics. Finally, the company made a strategic acquisition in the form of Kinney Shoes. The move allowed it to expand and include footwear in their range of products which proved to be highly profitable in the years to come.

Woolworth Becomes A Major Footwear Retailer

Woolworth was the best thing that ever happened to Kinney's. Under the new management, Kinney Shoes expanded, and it set up new stores along with the Kinney sections in Woolco stores. Woolworth also started new shoe factories to match the demand for Kinney shoes at all their new locations. It was just the beginning, and Woolworth soon diversified the Kinney section to open a brand new and separate footwear section called StyleCo. By the early 1970s, Kinney Shoes had nearly tripled Woolworth's annual sales to $358 million.

Foot Locker Appears On The Scene

In 1974, the Woolworth corporation decided to create a new Kinney Shoes division called Foot Locker, exclusively selling athletic footwear. The first Foot Locker stores were opened in a mall in California’s City of Industry. Initially, the athletic footwear business started slow and throughout the 1970s, it only accounted for about 2 percent of all Woolworth sales.

However, the situation was about to change drastically for Woolworth. In 1981, the company lost $19 million, and as if that was not bad enough, they recorded a further loss of $21 million in the next six months. The situation was so bad that the company was forced to sell off its British chain, hoping that a leaner company portfolio would help Woolworth get back on track. The newer company consisted of Kinney Shoe Corporation (Foot Locker), now a $1.1 billion division.

Then company president John W Lynn strategically started shifting Woolworth away from less profitable ventures and towards specialty retailing, focusing on the increasingly lucrative Foot Locker stores. The stores had proven so popular that the Canadian division launched the first Lady Foot Locker. Soon, Woolworth had opened up almost 900 new Foot Locker and Lady Foot Locker stores.

Iconic Uniform

In 1988 Foot Locker got a facelift with a brand new logo that featured a man in a black and white uniform similar to that worn by match referees. Even the staff at Foot Locker stores dressed in a black and white uniform. The distinctive uniforms and the iconic logo serve as a textbook example of a master-class in branding because it made Foot Locker instantly recognizable worldwide. It cemented the retailer’s identity as a leader in the athletic footwear industry. As the 80s came to a close, Foot Locker and its Lady Foot Locker subdivision accounted for 20 percent of all branded athletic footwear in the United States.

However, just when it looked like Woolworth was back in business, things took a turn for the worse with a breakout of a significant company scandal that undermined shareholder confidence. The management appointed Roger Farah to salvage the situation, and his main priorities included adjusting the cash flow, restructuring company debt, and cutting down operational costs by $100 million. Farah also sold off more unprofitable chains such as a pharmaceutical line and revamped the remaining Woolworth stores to include higher quality goods at premium prices. Farah wanted to cash in on the customer preferences of working women who often had limited time to do their shopping. As a result, the revamped stores focused on providing stylish clothing and cosmetics. Indeed, times had changed, and Woolworth had changed with them. Gone were the original five-and-dime stores, replaced by ultra-modern superstores with high-end apparel and coffee bars. But more changes were yet to come that would eventually lead the company to where it is today.

Becoming the Largest Athletic Footwear Retailer in the World

By 1996, the company was clearly headed towards becoming a sports apparel and footwear conglomerate. One factor that caused this shift in Woolworth's outlook was the stiff competition that even the revamped Woolworth stores faced from rivals Walmart. The stores were incurring huge losses and could not compete with the more well-established Walmart chain. Consequently, the top management at Woolworth redirected its energies to building its budding athletic footwear empire on the shoulders of the successful Foot Locker and Champs lines. To expand their portfolio, the company was determined to acquire other footwear retail chains such as Sporting Goods, Athletic Fibers, and Eastbay Incorporation, which increased the range of products they could offer their customers.

Woolworth even renamed itself the Venator Group to reflect its new brand image. Venator is a Latin word that loosely translates to the English word sportsman. Under Venator Incorporation, Foot Locker became the leading athletic footwear retailer in the United States, with sales hitting the $6.6 billion mark in 1997. Furthermore, the Venator Incorporation's Athletic Group, which included Foot Locker and Champs, and Sports Authority, became the largest footwear retailer worldwide with a record number of 7200 stores in 12 countries across the globe and a 45 percent share of the U.S athletic footwear market.

The Athletic Group sold athletic shoes and clothing from vendors worldwide. In 1996, twenty-five percent of all shoes sold by the Athletic Group were supplied by Nike alone. The Foot Locker stores sold all the big brand athletic footwear, including Reebok, Adidas, Converse, Air Walk, and of course, the Nikes.

The company had transitioned to retailing footwear at just the right time when interest in athletic footwear was growing due to the growing popularity of big-league sporting events. Consequently, Foot Locker stores successfully sold footwear for all sports, including football, basketball, tennis, and track and fitness equipment. Foot Locker also signed deals with major sports associations such as the National Football League (NFL) and the National Basketball Association (NBA). The company became the official provider of all sporting equipment such as clothing and footwear for athletes competing in big league tournaments.

Key Takeaway 3: Strike While the Iron is Hot

Woolworth fought hard to keep its Woolco stores profitable, even going so far as to completely change the store concept, targeted customer base, and product range. However, the market had changed, but this time, Woolworth did not need to be taught the same lesson twice. The company closed down all its Woolco stores. However, it paid close attention to its athletic footwear chain because it was the only venture bringing in profits and in line with evolving consumer preferences. By separating the athletic chain into an independent group, the company expanded its operations and established partnerships with some of the biggest shoe brands such as Nike and Adidas. The strategic acquisition of Eastbay Incorporation also played a crucial role in making the Athletic Group the global retail leader in athletic footwear.

Foot Locker In the 21st century

As Venator Incorporation entered the 21st century, it was clear that its Kinney Shoe line would have to be discontinued as consumer preferences had shifted towards athleisure. Foot Locker remained the sole driver of sales, so the Venator Group renamed itself as Foot Locker in 2001 to firmly establish itself as a sports footwear brand. Twenty years later, the company has evolved some key strategies to help it retain its top spot in the industry and stay relevant in the face of new entrants into the athletic footwear market.

The Digital Marketplace

As early as 1998, the company had realized the importance of aligning itself to consumer preferences. The exclusive mall culture of the 60s and 70s was fading, and consumers now wanted multiple retail options. As a result, Foot Locker started opening stores outside malls and created a brand new website to reach customers who wanted to shop online. The company created a holistic digital marketplace for customers with the entire catalog at their disposal to easily compare models and prices.

The importance of a user-friendly website cannot be stressed enough, and Foot Locker is very well aware of that. In 2017, the company spent months fine-tuning its website to integrate its online and in-store operations fully. The move came after sales took a hit in early 2017 as Nike shoes declined in popularity. Foot Locker did not see customer preferences changing so suddenly, but the situation pushed the company to create a new digital platform.

The new platform allows Foot Locker to tap into customer preferences more effectively. It also helps them showcase their in-store products in a way that tells customers they will only get the best at Foot Locker, and that is precisely what customers want. After all, many customers now visit their favorite brands online before deciding to hit the stores, so the website is often their first window into the brand. This is why the website overhaul helped boost sales in 2018 because customers could now get onto a site that worked faster and more seamlessly than ever before.

Strategic Acquisitions

Foot Locker also shifted away from its traditional strategy of opening up more Foot Locker stores. Instead, the company has increased profitability and market share by undertaking strategic acquisitions of smaller retailers. In 2018, Foot Locker invested in a women's athletic apparel brand named Carbon38, followed by a $12.5 million investment in Rockets of Awesome and a $3 million share in Super Heroic. These up-and-coming chains cater specifically to children and will help drive sales in Kids Foot Locker stores. Additionally, the company spent $200 million to partner with Pensole which is a sneaker design academy.

The same year, the company spent $100 million to acquire GOAT Group, which operates the most popular sneaker resell platforms. With this acquisition Foot Locker aims to bridge the gap between the primary and secondary sneaker markets.

The following year, Foot Locker put together a $360-million-dollar deal to acquire Japanese footwear line atmos. There is a logic behind all these investments. By acquiring other retail brands, Foot Locker can tap into customer data to find out what customers are buying. The goldmine of information that it gets from its subsidiaries helps Foot Locker catch shifts in consumer preferences so that it can continually re-align its brand image to meet customer expectations.

The strategy is clearly paying off, as evidenced by the steady increase in sales the company has seen over a period of seven years, from sales worth $6.5 million in 2013 to a high of $8 million in 2019. Understandably the sales took a hit in 2020 due to the Covid-19 pandemic, but the company still managed to hit the $7.5 million mark.

Sneakers With A Cause: The Case For Community Retail Spaces

Another way Foot Locker has managed to stay relevant and connected with consumer expectations is by actively rebranding itself to align with the younger generation and has re-imagined its stores as a youth empowerment space. Called 'Power Stores,' they aim to promote sneaker culture by connecting it to pressing issues such as youth empowerment and community building. The company runs multiple programs to facilitate high school athletes with scholarship grants and holds community events at its Power stores, such as pop-up events and gaming sessions.

Foot Locker remains popular with shoppers because it provides one-of-a-kind products to its customers that cannot be bought anywhere else. With its latest acquisition called Pensole, the company partners with local creators to create unique sneaker designs. These unique designs are only available at Foot Locker stores and are part of the company's community-building efforts. Customers get a chance to purchase rare sneaker designs and leave the store knowing that they are supporting their community as these new designs are often displayed at community events like educational workshops and business events.

Key Takeaway 4: Know Thy Consumer

The most significant factor in Foot Locker’s success as a global retail leader in athletic footwear and apparel has been its determination to stay in touch with its consumer. Every move the company has made has stemmed from its goal to meet and exceed consumer expectations. It has revamped its digital platforms so that customers have seamless access to its products, as most people prefer shopping online these days due to the pandemic. Foot Locker has also acquired multiple retail brands to stay on top of changing shopping patterns and consumer preferences. Finally, the company realizes that it cannot conduct business like a traditional retailer. To attract customers, the company has successfully projected itself as a brand with a mission to empower today's youth by turning its stores into community spaces.

Foot Locker Today & Key Strategic Takeaways

Foot Locker is the world's leading global athletic footwear and apparel retailer that literally lives, breathes, and dreams sneakers and athleisure. Such is the dominance of Foot Locker that it's often said, "If a product is at Foot Locker, then it is approved!"

With exclusive partnerships with the world's leading brands and an experience-driven strategy that aims to inspire and empower youth, Foot Locker is redefining the way business is done for the better.

Key Strategic Takeaways

Don't Be Afraid To Start Again

From Woolworth's 'Great 5¢ Store' and WWII setback to discontinuing the Kinney Shoe line and rebranding Foot Locker to stay competitive in the dynamic digital age, there are countless times when Foot Locker started again. The company just never gave up right from the very beginning. Plus, it always learned from its shortcomings and bounced back come what may. The world of business takes no prisoners, and it's not easy to tackle the tricky water of the competitive landscape. Foot Locker knows that better than everyone else, and hence, it does what others cannot – keep going and not quit despite setbacks.

Always Delight The Customers

Featuring a diverse product collection, offering tailored experiences, and taking customer feedback to improve, Foot Locker does everything in its capacity to do right by its customers. Foot Locker has, does, and will always strive hard and even obsess over delighting its customers. This is a given, and Foot Locker's customers know that. This is why they trust the company time and again. This is not all. The company has fostered a culture that refers to the customer as the king and puts them at the center of every decision-making process. Will the customer benefit from it? What value will the customer get? These are the questions frequently asked before making any decision. Plus, Foot Locker has even established a Center For Excellence and customer-connected framework to further elevate the customer experience. For all brands out there, it highlights an important lesson: leave no stone unturned in catering to the needs of the customers and delight them at every opportunity you get.

Rebranding Can Help

Not everything will always go according to plans. And there will come a time when your brand might become outdated. When that happens, waste no time and rebrand yourself. That's exactly what Foot Locker did to breathe new life into itself. Foot Locker has recently rebranded itself not just as a wonderful place to shop the best and the latest footwear and athleisure but also a social place where the youth can feel at home – a place that inspires and empower youth. The significant change in the way Foot Locker operates and presents itself is a testament to the company's willingness to put its money where its mouth is. It understands that consumer preferences are ever-evolving, and they need to adapt to stay relevant. Hence, the company is doubling down on investing in creating an ecosystem to serve youth culture, acquiring various startups focused on empowering youth, and launching the new 'power stores.'

Collaborate Your Way To Success

Alone you can only go so far. Together, the sky is the limit to what you can achieve. From Woolworth and Kinney's Shoes joining hands to collaborating with the best brands in the world and going on an acquisition spree, Foot Locker leverages partnerships to strengthen its brand and service its customers. The company has made numerous collaborations throughout its history, and it is one of the main reasons behind its success and exponential growth in a relatively short time period. For all businesses – small and large – around the globe, this acts as a key lesson – make mutually beneficial partnerships to solve problems, expand quickly, enhance capabilities, and leverage the synergies to scale.

Transform Digitally Sooner Rather Than Later

Innovation centers in retail outlets that help Foot Locker deliver more intelligent and customized product recommendations, embracing eCommerce to deliver unique technological customer experiences online, producing compelling storytelling content online that appeals to the customers and connects with them, harnessing the power of data to gather insights, and experimenting with new technologies such as augmented reality among others are just a few of the things Foot Locker is doing to go digital. This is because it understands how crucial digital transformation is nowadays. As a business, if you want to survive and thrive in today's dynamic digital age, you've got to harness the power of digital and transform your business and adopt a digital-first strategy. Period.

Foot Locker – even after more than one and half centuries since the inception of its predecessor company – is a company that's a work in progress. It's reinventing yet again to remain at the top in changing times. While we are not sure of what the future holds, we can, without a doubt, count on Foot Locker to continue to cater to its customers' needs and preferences, delighting them with it’s wide range of offerings.