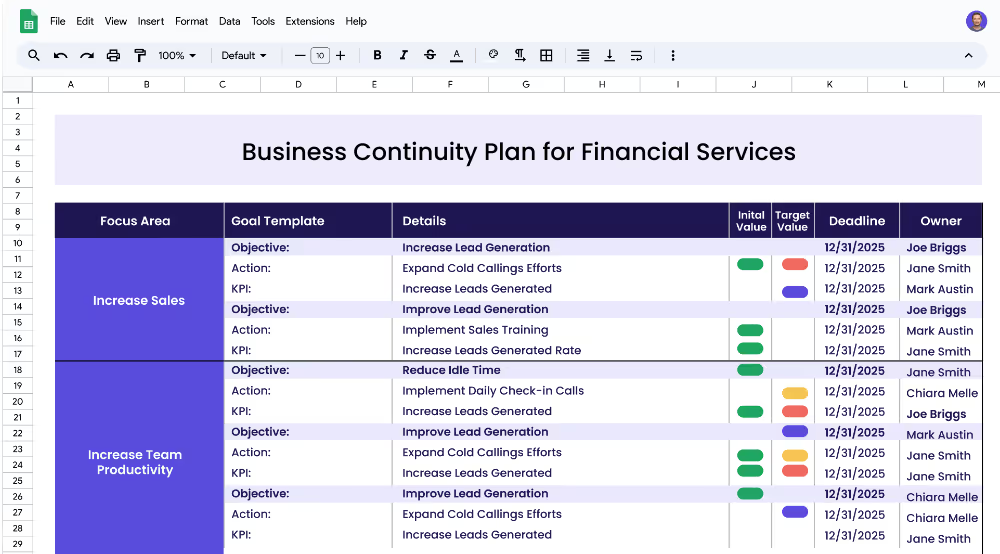

A Business Continuity Plan (BCP) for Financial Services is a plan designed to ensure the continuity of critical financial operations and services. BCPs are designed to help banks, financial institutions, and other organizations in the financial services industry develop their business continuity plans and prepare for any disaster or disruption that could threaten their operations. The plan is designed to provide strategies for mitigating risks, developing business continuity plans, maintaining technology infrastructure, and ensuring regulatory compliance.

Each focus area has its own objectives, projects, and KPIs to ensure that the strategy is comprehensive and effective.

This Business Continuity Plan for Financial Services template is designed for banks, financial institutions, and other organizations in the financial services industry who need a comprehensive plan for addressing potential risks and disruptions to their operations. The template outlines the steps needed to develop an effective BCP, including focus areas, objectives, targets, and projects.

Focus areas are the major categories in which objectives and projects are organized. When creating a Business Continuity Plan, it is important to identify the focus areas that are most relevant to your organization’s operations. Examples of focus areas could include risk mitigation strategies, business continuity planning, technology infrastructure maintenance, and regulatory compliance.

Objectives are the goals or outcomes that need to be achieved in order to complete a focus area. When creating a Business Continuity Plan, it is important to define the objectives that will help you achieve the desired outcome for each focus area. Examples of some objectives for the focus area of Ensure Business Continuity could be: Establish Risk Mitigation Strategies, and Develop Business Continuity Plan.

KPIs, or key performance indicators, are metrics that are used to measure the success or progress of an objective. When creating a Business Continuity Plan, it is important to identify the KPIs that can be used to track the progress of each objective. An example of a KPI for the focus area of Ensure Business Continuity could be: Evaluate Risk Factors.

Projects are the actions that need to be completed in order to achieve the objectives. When creating a Business Continuity Plan, it is important to identify the projects that need to be completed in order to achieve the desired outcome. An example of a project related to Ensure Business Continuity could be: Identify and Assess Risk Factors.

If you’re ready to accelerate your strategy and see faster results, consider using Cascade Strategy Execution Software. Unlike spreadsheets, Cascade provides a streamlined platform designed to help you create, track, and execute your strategy with ease. Sign-up for free or book a demo with one of our strategy experts to get started today!