A business continuity plan is a set of strategies and processes designed to help financial technology (FinTech) companies respond to and recover from disruptions and disasters. This plan outlines the steps required to minimize the impact of such events to ensure the long-term health of the company. The plan should define procedures to maintain critical operations, mitigate risk, and protect the company’s assets, employees, and customers.

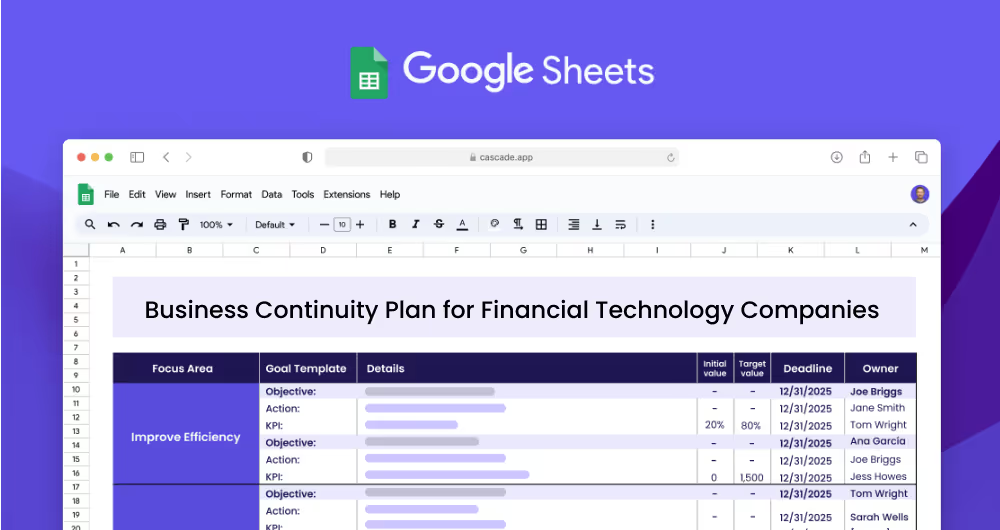

Each focus area has its own objectives, projects, and KPIs to ensure that the strategy is comprehensive and effective.

This template is designed for FinTech companies and startups looking to create a comprehensive business continuity plan, addressing the unique risks and challenges in the financial technology industry. The template provides step-by-step guidance to help companies identify, mitigate, and manage risks, develop a disaster recovery plan, establish security policies, and ensure regulatory compliance.

The focus areas of a business continuity plan are the broad categories that the plan should address. For FinTech companies, these focus areas typically include Risk Management, Data Security, and Compliance. Each focus area should be broken down into specific objectives, actions, and KPIs to ensure that the plan is comprehensive and covers all necessary topics.

Objectives are specific goals that the plan should achieve. These should be clearly defined and measurable, so that progress can be tracked. For example, under the Risk Management focus area, an objective could be to “Identify & Mitigate Risks”.

A KPI (Key Performance Indicator) is a measurable target set to track progress toward an objective. For example, under the objective “Identify & Mitigate Risks”, a KPI could be to “Increase risk awareness”.

Projects are specific actions or initiatives that are implemented to achieve the KPIs. For example, under the KPI “Increase risk awareness”, the project could be to “Develop a risk identification & monitoring framework”.

If you’re ready to enhance your strategy beyond basic spreadsheets and achieve rapid, more consistent results, Cascade Strategy Execution Software is your essential tool. Unlike spreadsheets, which can become cumbersome and error-prone as strategies grow, Cascade provides a centralized platform with real-time updates and intuitive dashboards, greatly enhancing visibility and ensuring seamless execution of your strategic plans. Efficiently manage and align your strategies across various teams with Cascade's robust feature set, including automated reporting and strategic milestone tracking. Sign-up for free or book a demo with one of our strategy experts to see how we can transform your strategy execution today.