A business continuity plan for insurance agencies is a critical plan that outlines the strategies, processes, and systems that insurance agencies and brokers should have in place to ensure operational continuity in the face of unexpected events or emergencies. It includes detailed guidance on maintaining the continuity of insurance services, claims processing, and customer support. This plan should be regularly updated to ensure it remains relevant and effective.

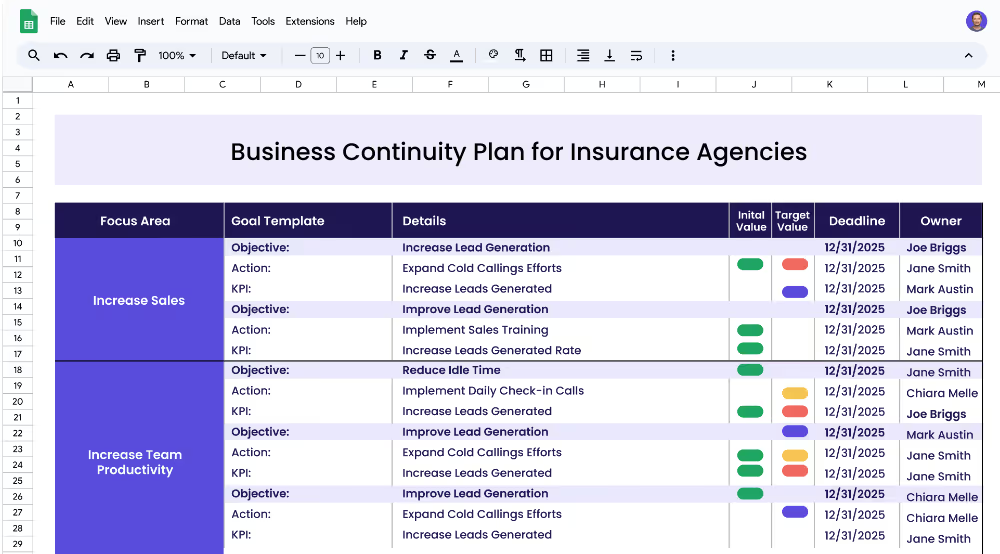

Each focus area has its own objectives, projects, and KPIs to ensure that the strategy is comprehensive and effective.

This template is designed to help insurance agencies and brokers develop and execute their business continuity plans. It includes step-by-step guidance to help them define their focus areas, objectives, and key performance indicators (KPIs), as well as the projects or actions needed to achieve the KPIs.

Focus areas are the general areas of business operations that your strategy will address. For example, a business continuity plan for insurance agencies may include focus areas such as business continuity, risk management, and resource management. It is important to define clear examples of your focus areas to ensure that your strategy is tailored to the specific needs of your business.

Objectives are the desired outcomes that you want to achieve in each focus area. For example, under the focus area of business continuity, your objectives may include maintaining operational continuity and minimizing customer disruptions. Your objectives should be specific and measurable.

Key performance indicators (KPIs) are measurable targets that you set for each objective. For example, under the objective of minimizing customer disruptions, you may set a KPI of reducing customer disruption from 2 days to 1 day. Setting measurable targets helps you track your progress and adjust your strategy as needed.

Projects or actions are the steps that you need to take to achieve your KPIs. For example, to reduce customer disruption from 2 days to 1 day, you may need to establish alternative customer support channels. Your projects should be specific, achievable, and measurable.

If you're ready to accelerate your strategy and experience faster, more tangible results, Cascade Strategy Execution Software is the ideal next step. Unlike spreadsheets that can bog down the dynamics of progressive strategies, Cascade offers a centralized, scalable platform that provides real-time updates, centralized collaboration, and automated reporting. This allows your team to effectively adapt quickly to changes, all while maintaining alignment with your business goals. Elevate your strategy management with tools that integrate your planning and execution seamlessly. Sign-up for free or book a demo with one of our strategy experts today!