A commodity trading strategy is a plan of action created to help individuals and organizations achieve their financial goals in the commodity markets. This plan outlines how the trader will approach the markets, what kind of investments they will make, and how they will manage their risks. Commodity trading strategies focus on the buying and selling of physical commodities, such as oil, gold, and grains, as well as the derivatives and futures markets.

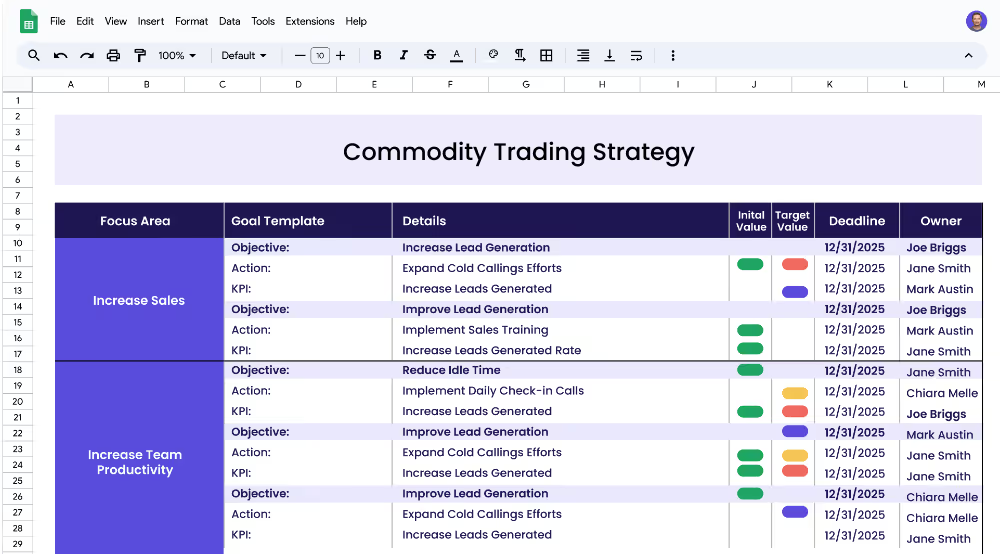

Each focus area has its own objectives, projects, and KPIs to ensure that the strategy is comprehensive and effective.

The Commodity Trading Strategy template is designed for commodity trading firms and investors who want to create strategies for trading and managing commodity investments in volatile markets. The template helps to simplify the process of strategy development by providing an easy-to-follow structure for creating a successful commodity trading strategy.

A focus area is a specific area of an overall trading strategy that you will be focusing on. Examples of focus areas could include risk management, market analysis, and portfolio management. By clearly defining your focus areas, it will be easier to set objectives and develop projects to achieve them.

An objective is a goal that you wish to achieve within a certain focus area. Objectives should be measurable and concrete, so that you can track your progress and determine if you are achieving your goals. It is important to think carefully about which objectives will help you achieve your overall trading strategy. Examples of some objectives for the focus area of Risk Management could be: Enhance Risk Assessment, and Monitor Risk Exposure.

KPIs, or Key Performance Indicators, are measurable targets that you set in order to track your progress and determine if you are achieving your objectives. KPIs should be specific, measurable, achievable, relevant, and timely (SMART). They should also be related to the objectives you have set for yourself. An example of a KPI for the focus area of Risk Management could be: Increase accuracy of risk assessment model from 70% to 90%.

A project (or action) is a specific plan of action that you will take in order to achieve your KPIs. Projects should be related to the objectives that you have set, and should be specific and achievable. For example, if one of your objectives is to improve market insights, one of your projects might be to create a market analysis dashboard. An example of a project related to Risk Management could be: Develop risk assessment model.

If you’re ready to accelerate your strategic initiatives and achieve faster, more reliable results, Cascade Strategy Execution Software is your next step. Escape the limitations of cumbersome spreadsheets and embrace a dynamic, centralized platform that offers real-time updates and automated reporting. This allows your team to collaborate efficiently, adapt swiftly to market shifts, and maintain strategic alignment at all levels. Sign-up for free or book a demo with one of our strategy experts to begin optimizing your strategies today!