An investment plan is a comprehensive and strategic approach that outlines how an organization can manage investments and achieve financial goals. It serves as a blueprint for identifying and analyzing potential investments, assessing risk, and allocating resources. It also helps to monitor progress and make necessary adjustments along the way.

This plan is built by considering the organization's financial position, risk tolerance, growth ambitions, and market conditions. It typically involves a set of objectives, metrics, and initiatives that align with the overall business plan.

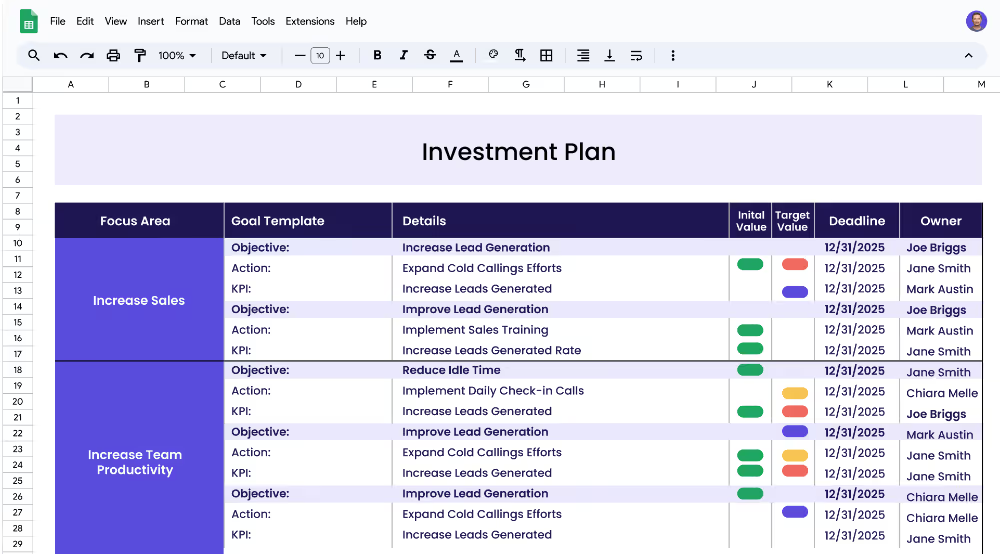

Each focus area has its own objectives, projects, and KPIs to ensure that the strategy is comprehensive and effective.

After setting up your template, you have the option to create live dashboards and reports that provide real-time monitoring of performance.

And the best part is, no credit card is required for access. It's completely free! ✅

The investment plan template is a versatile tool designed for organizations of all sizes, spanning from established corporations to startups across diverse industries. It caters to the needs of both well-established players and emerging ventures.

In the case of large organizations, the template acts as a strategic guide for managing varied portfolios. For instance, a multinational company could use the template to allocate resources among different business units, analyze and measure potential returns, and mitigate risks.

On the other hand, for startups, the template can provide a structured framework to attract potential investors and secure funding. It helps entrepreneurs outline growth paths that can include research and development, marketing strategies, and product launch plans. This holistic approach enables venture capital firms to understand a startup's potential and invest confidently.

Investment companies and venture capital firms can also harness the template effectively. They can use it to effectively manage their investment portfolio, evaluate prospects, assess risks, and align proposed ventures with market trends. This streamlined approach enhances decision-making, enabling them to choose good investments with optimal return potential.

📚 Recommended read: Best Practices For Effective Private Equity Portfolio Monitoring

The primary beneficiaries of the investment plan template are the finance teams and the leadership team.

Finance teams can use the template to strategically allocate assets, monitor investment performance, and enhance resource usage within their financial plans.

Similarly, the leadership team—including executives and board members—can extract insights from the template to align investment strategies with the organization's overall goals, helping drive sustainable growth.

While these are the two teams that usually find the most value, the template can be used by any team member involved in projects or initiatives that could directly or indirectly impact the investment plan.

Our template is very intuitive and easy to set up and use. You just need to sign up for a free forever plan in Cascade to get immediate access to the template and follow the steps below.

The first step in creating your Investment Plan is to identify and define your focus areas. Focus areas are broad topics that encompass the goals that you want to accomplish.

Focus areas in the Investment Plan Template could be:

💡Remember, the beauty of the investment plan template lies in its adaptability. You can tailor these focus areas to precisely match your organization's unique needs, objectives, and industry dynamics, ensuring that your investment plan aligns seamlessly with your strategic vision.

Sometimes, defining your focus areas is easy because your organization has clarity on what the priorities are for the business. But that’s not always the case...

If you’re not sure about what key areas you should focus on, we suggest you conduct an internal analysis to detect weaknesses and strengths within your organization—you can do this by conducting a SWOT Analysis. But don’t stop there; it’s also important to consider the external factors that could impact your investment plan.

Conducting market research will allow you to pinpoint trends as well as threats and opportunities—a PESTLE Analysis should give you a holistic view of external factors.

Once you have identified your focus areas, the next step is to set objectives. Objectives must be clear and concise since they are the specific goals that you want to achieve within each focus area.

Examples of objectives for the focus area of “Operational Efficiency Enhancement” could be:

The next step is to set measurable targets, also known as Key Performance Indicators (KPIs). KPIs are quantifiable metrics that can be used to track progress towards achieving your objectives. They should be specific, measurable, achievable, relevant, and timely.

Possible KPIs for the objective of “Creating accurate and data-driven financial projections[...]” could be:

📚 Recommended read: Financial KPIs - 12 Key Finance Metrics You Should Be Tracking

After identifying your KPIs, the next crucial step is putting those plans into action through relevant projects. These projects are specific actions strategically aligned to propel you toward your goals. Be sure to incorporate a mix of short-term and long-term projects to enable comprehensive progress tracking.

Examples of projects for the objective of “Creating accurate and data-driven financial projections[...]” could be:

💡Pro Tip: To accurately monitor the progress of your big projects, we suggest you break them down into smaller milestones.

Cascade helps organizations connect siloed metrics, initiatives, and investments with their realized performance for accelerated decision-making. It is the only platform that spans the entirety of your ecosystem to understand the relationships between your business inputs (e.g., metrics, initiatives, investments) and outcomes (e.g., expected results, forecasted revenue, margins, etc.)

Some of the star features that will enhance your investment plan are:

.avif)

.avif)

👉🏻Grab your free Investment Strategy Template today and embark on a journey to enhance your financial foresight, drive sound investment decisions, and pave the way for sustainable growth.

Yes, it's 100% free! Simply create a free forever plan in Cascade and gain instant access to the template. For more information about other Cascade plans, visit our pricing page.